Unlock Your Client’s Relationship With Money using Money StoryTypes™

Your Gateway to Engaging Transformative Deeper Financial Conversations

Attract the right clients

The Money StoryTypes tool provides valuable insights that enable you to target the prospects you know will become long-lasting clients. The higher levels of client trust the tool garners will earn you more referrals, helping your business grow.

Deepen client relationships

When you help your client have that difficult conversation about their feelings and money, you become their trusted advisor, the person they feel safe with and have confidence in to lead them to financial freedom.

Improve client retention

Getting to the core of your client’s money mindset leads to better financial outcomes. Using the Money StoryTypes tool to initiate these important conversations will see your client retention rates skyrocket. Demonstrate you are adding value to your clients in a time of market turmoil.

Sound familiar?

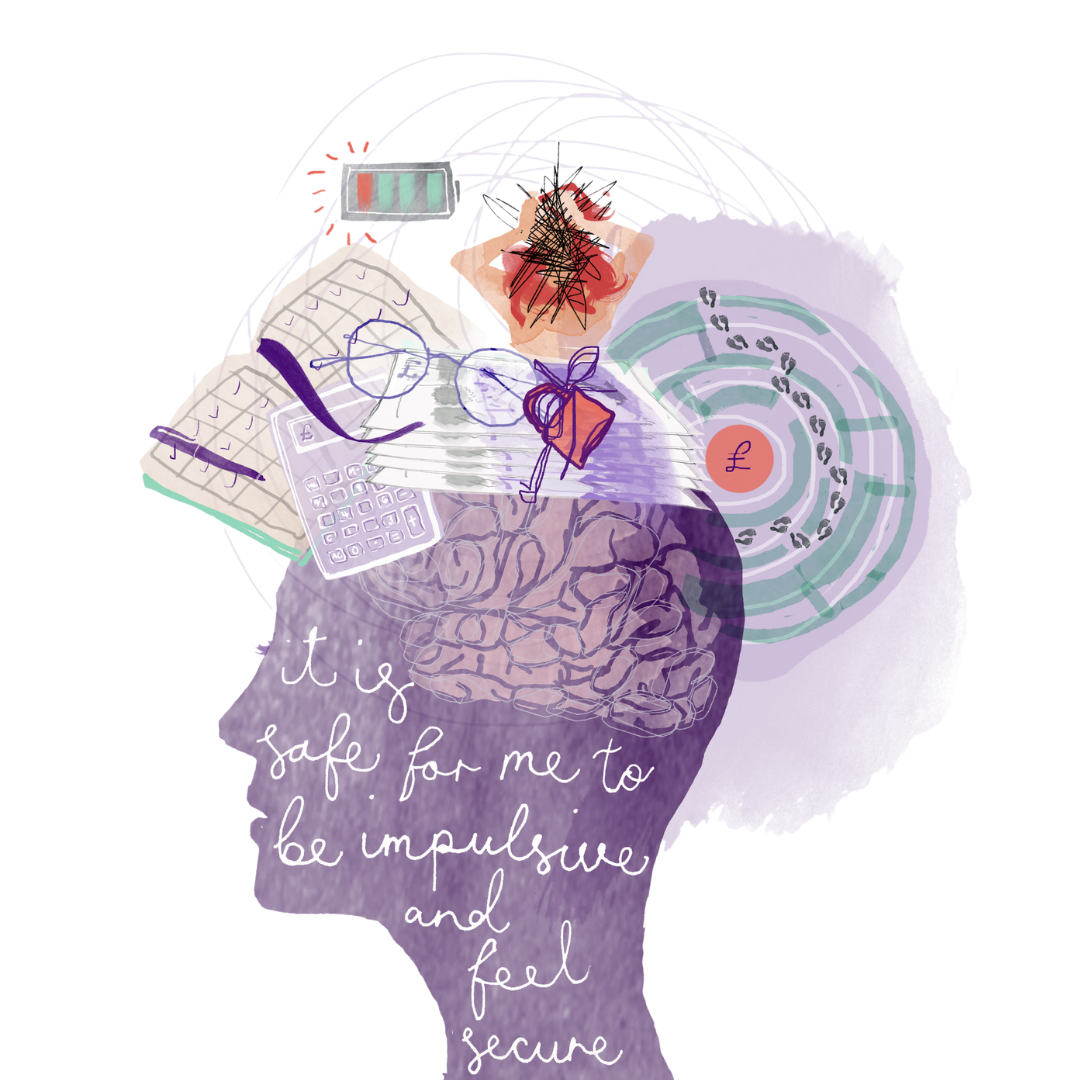

Do you feel like you could offer more than traditional financial advice? Do you want to dig deeper than the latest products and plans?

You see your clients’ self-sabotaging behaviours and emotional reactions to their wealth. You want to help them improve their habits through meaningful conversation but you’re not sure how to kick it off.

If you want to set yourself apart from the competition by tapping into the human side of financial advising, while at the same time generating high-quality leads, the Money StoryTypes™ tool is for you.

ABOUT US

Money StoryTypes™ was created by Catherine Morgan, Founder of The Money Panel® as a tool to start engaging and insightful conversations with clients about their relationship with money.

“The way we treat money is a reflection of the way we treat ourselves.”

- Featured in Business Leader’s ‘Top 32 female entrepreneurs to look out for’

- Author of Amazon’s number one best-seller ‘It’s not about the money’

- International speaker on financial wellbeing

- Host of the top 0.5% global podcast ‘It’s Not About The Money.’

Catherine’s mission is to reduce financial anxiety and increase financial resilience for one million people worldwide, empowering them to be independent, not co-dependent with money.

We have seen the profound impact of Money StoryTypes™ in action with the members of the pension schemes under our care in Jersey.

The realisation post pandemic that connecting with clients is a critical part of financial wellbeing leads to discussions around proper financial planning and Money StoryTypes™ is a powerful tool to help advisers and their clients reflect on and better understand the way we behave with money.

It is this human side of money coaching that planners of the future will need to fully harness and this insightful tool does precisely that!

Features

Pre-written

All the content has been carefully crafted and ready to use.

Bespoke

Your logo and optional branding can be added to your assessment.

Dynamic Result Videos

Build trust and rapport with custom videos based on how a prospect answers.

Advanced Data Segmentation

Automatically tailor your follow up process.

View and Track Leads

Access the Assessment Portal to view leads in one place.

Marketing Playbook

Access to the most up-to-date assessment marketing best practises.

Pricing

Choose your plan below. All available with optional addons to further personalise your assessment to you and your business.

Choose our annual plan and get 2 months free!

Basic plan

Foundational Money Insights- Add your logo on the assessment and report (co-branding)

- 1 user included

- Up to 25 reports each month

Pro Plan

Elevated Financial Conversations- All inclusions in Basic, PLUS…

- Connect to your CRM

- 3 users included

- Up to 100 reports each month

Premium Plan

Transformative Money Journeys- All inclusions in Pro, PLUS…

- Advanced team tagging and tracking

- 5 users included

- Up to 250 reports each month

Optional Add-ons Available

Full White-label branding service

Transform your Money StorytypesTM with a full custom branding service, including personalised designs and a unique domain for a white-labeled solution.

Add £299 once-off.

Results Video Editing Service

Record with our script we provide you and share the footage; our team will expertly edit and integrate the videos into your assessment.

Add £299 once-off.

Contact us

Get in touch with us to get started today:

FAQs

What is considered as “1 report”?

A ‘report’ or sometimes known as an entry, is a unique entry from either a person (e.g. a lead or client) completing your assessment. Duplicate people only count as 1 report.

How quickly can I get up and running?

Once you sign up and complete the onboarding form, your assessment will be operational typically within 3-5 business days.

What happens if I hit my monthly limit?

We will simply notify you with your options to either upgrade your account or pause the assessment until the next month begins.

Can it connect to my CRM?

We can integrate with the majority of CRM systems, including but not limited to Active Campaign, IRIS, Salesforce, Wealthbox and hundreds of others.

Can I change plans?

You can easily change your plan at any time to better suit your evolving needs and client base.

Am I locked into a contract?

No, there are no long-term contracts or commitments.

Can we chat first?

Certainly. Please email us to schedule a time to speak with our team. Emailus at hello@themoneypanel.co.uk

Images desired by Bryony Fripp